Stable Assets, Yield Markets, and Payments: DeFi’s Next Stage on Avalanche

Stable Assets, Yield Markets, and Payments: DeFi’s Next Stage on Avalanche

Sep 26, 2025 / By Avalanche / 5 Minute Read

Ethena, Pendle, and PayPal USD (PYUSD0) strengthen Avalanche’s role as the foundation for decentralized finance.

Avalanche’s DeFi ecosystem is entering a new stage of development. Three significant integrations, Ethena’s synthetic dollar (USDe and sUSDe), Pendle Finance’s cross-chain PT markets, and PayPal USD (PYUSD0), are expanding the network’s foundation with new stable assets, structured yield markets, and payment-ready stablecoins.

This momentum reflects a broader transition in DeFi. What began as fragmented experiments in yield and market depth is evolving into a structured stack built on stability, efficiency, and real-world utility. With deterministic settlement, sub-second finality, and full EVM compatibility, Avalanche provides the infrastructure for this next phase, where stable assets, yield markets, and payment rails converge into durable financial infrastructure.

Ethena: Expanding Stable Asset Options

Rewards are variable and are not guaranteed. There is a risk of loss of your total investment.

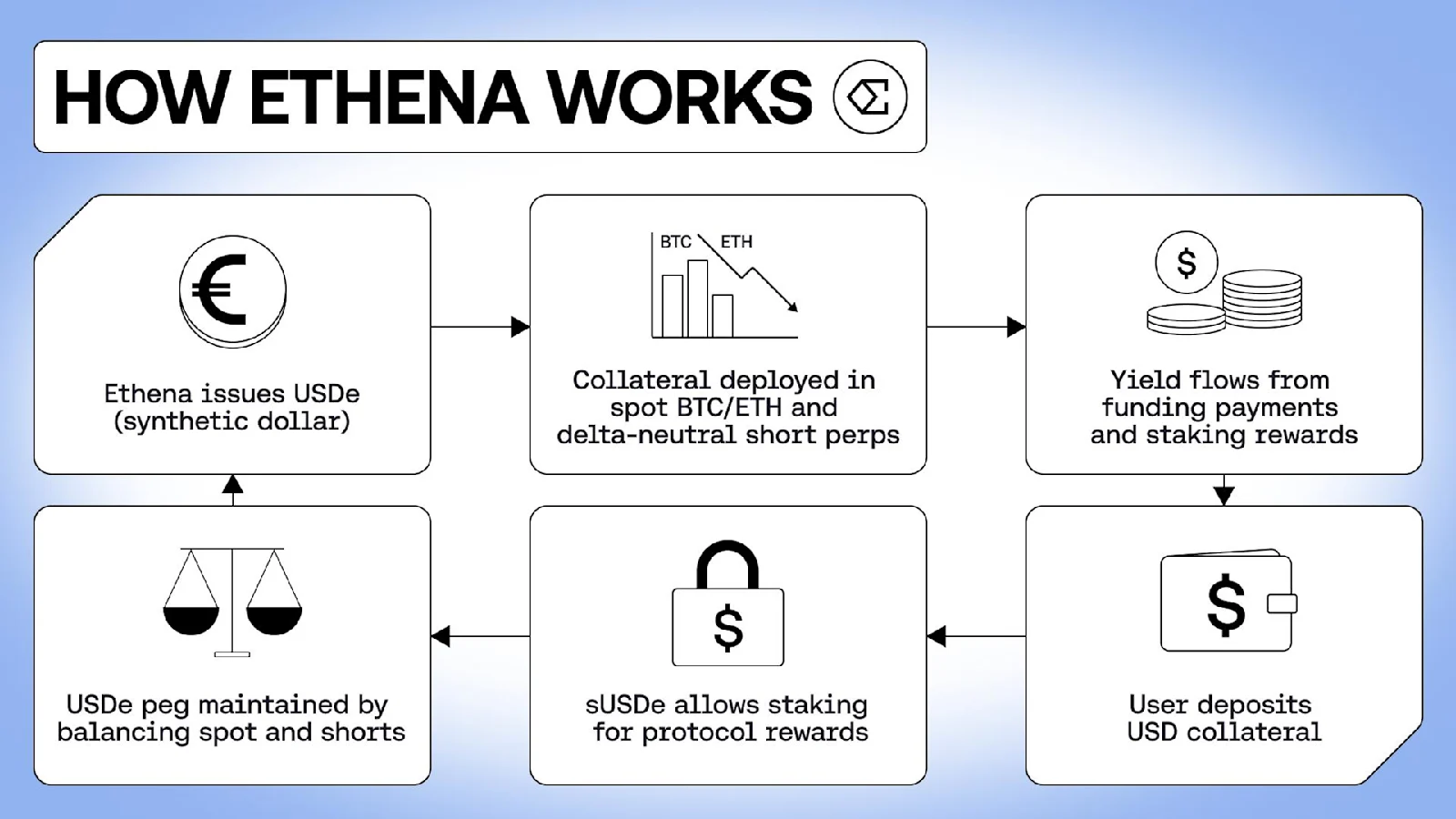

Stable assets are the foundation of modern DeFi. Ethena introduces USDe and sUSDe to Avalanche, bringing one of the most widely adopted synthetic dollar systems into the network.

USDe aims to maintain a $1 peg through a delta-neutral strategy that combines long BTC/ETH spot collateral with offsetting short perpetual futures. Unlike algorithmic or purely overcollateralized stablecoins, this model is designed to isolate USDe from direct crypto volatility, making it the largest synthetic stablecoin globally.

sUSDe, the staked variant, transforms USDe into a potential yield-bearing stable asset by distributing protocol revenues from three main sources:

Perpetual futures funding and basis fees when Ethena holds the short hedge;

Yield on stablecoin reserves; and

Staking rewards on collateral (when used).

Now live on Avalanche, sUSDe liquidity is available across Uniswap, LFJ, Pharaoh Exchange, Blackhole, and collateral integrations across Euler Finance, Silo, Folks Finance, and Term Labs.

By combining broad market depth, a proven hedging mechanism, and yield-bearing potential, Ethena expands the set of stable instruments available on Avalanche, strengthening the foundation for the network’s DeFi ecosystem.

Pendle: Yield Infrastructure at Scale

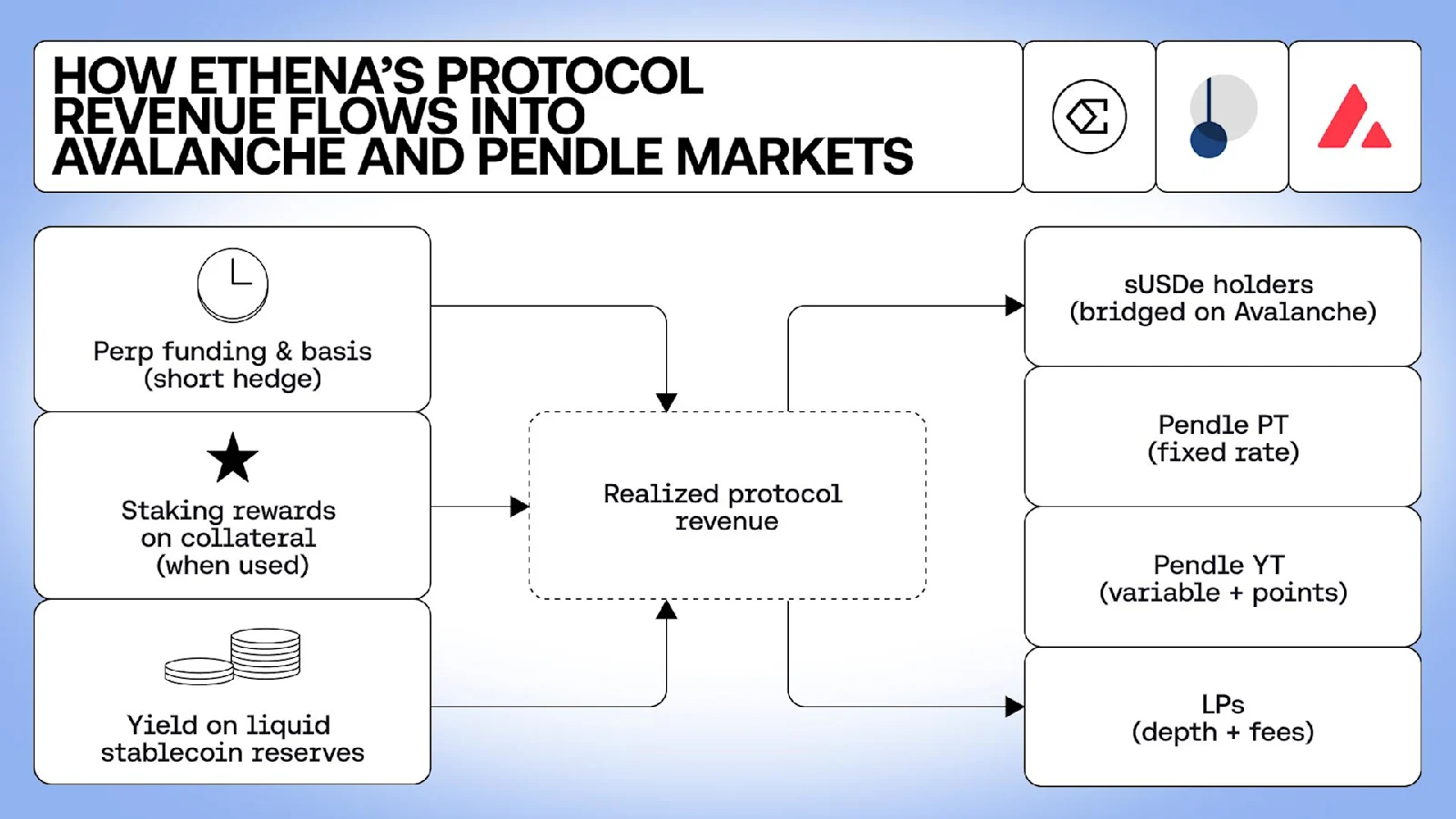

While Ethena expands stable asset options, Pendle provides the infrastructure to unlock yield through structured markets. Pendle launched on Avalanche with the first cross-chain Principal Tokens (PTs), enabling fixed and variable yield strategies around USDe and sUSDe.

Rewards are variable and are not guaranteed. There is a risk of loss of your total investment.

Pendle aims to separate yield into three components:

Principal Tokens (PTs): fixed-rate positions, discounted assets that mature at face value;

Yield Tokens (YTs): variable or leveraged exposure to yield streams; and

Liquidity Providers (LPs): earn swap fees and PENDLE incentives.

This model distinguishes Pendle from conventional DeFi lending, where yield exposure is bundled into a single position. By unbundling principal and yield, Pendle helps enable strategies that more closely resemble traditional fixed-income markets. PTs provide users with the ability to lock in more consistent returns, take targeted exposure to yield volatility, or access fees and incentives, unlocking fixed returns and greater capital efficiency across Avalanche’s DeFi stack.

On Avalanche, USDe PTs can be minted, bridged, and redeemed in a single interface, with cross-chain messaging facilitated by LayerZero. Transparency and settlement remain local to Avalanche, maintaining full composability. PTs are also expected to integrate into lending protocols such as Euler and Silo.

Pendle currently secures more than $5 billion in TVL, with roughly half represented by PTs used as collateral. By combining Ethena’s synthetic dollars with Pendle’s yield infrastructure, Avalanche now supports a sophisticated toolkit for managing risk, optimizing returns, and expanding collateral options.

Payment Infrastructure: PayPal USD (PYUSD0)

Stablecoins are evolving into a key infrastructure for payments and settlements. PayPal USD (PYUSD0), now accessible on Avalanche, represents this shift from speculation to real utility.

PYUSD0 is the permissionless, omnichain extension of PayPal USD:

Issued by Paxos, distributed via LayerZero, and moved through Stargate Hydra;

Expanded availability across 140+ blockchains through LayerZero’s distribution network; and

Full composability for integration into DeFi and payment applications.

On Avalanche, PYUSD0 is more than just another stable asset. With deterministic settlement, sub-second finality, and low fees, the network provides the infrastructure that enables digital dollars to be used at scale for remittances, merchant payments, and consumer applications.

This integration also bridges mainstream fintech with blockchain. PayPal, one of the first global digital payment networks, now extends its trusted digital dollars through Avalanche. As stablecoin transaction volumes are projected to reach $250 billion per day, PYUSD0 on Avalanche demonstrates how stablecoins can move beyond DeFi liquidity into payment-ready money for both institutional and retail settlement.

Building Toward a Comprehensive DeFi Stack

Avalanche’s DeFi TVL has more than doubled in recent quarters to $2.1B (as of September 2025), signaling growing adoption across lending, trading, and payments. The addition of Ethena, Pendle, and PYUSD0 marks more than ecosystem growth; it represents DeFi’s progression from speculative activity to foundational monetary infrastructure.

By combining scale, composability, and settlement speed, Avalanche is positioned as the network where stable assets, yield strategies, and payment-ready digital dollars can expand into the core of global finance.